The Strategy

The Overview

A Deep Dive

Founded in 2001, CAZ has grown to become one of the top 120 allocators to Private Equity worldwide.1 With over $10.3 billion in assets under management and a global network of investors, we utilize our collective purchasing power to allow for greater access to private markets.

By the Numbers

(as of 10/31/2025)

-

14.75%

Annualized Returns Inception-to-Date

(Inception 3/1/24, Class I Returns) -

$500M+

Total Fund Assets

-

$25.16

Current NAV Per Share Class I

-

15.89%

One-Year Return

-

$10.3B+

Over $10+ Billion in total assets under management with CAZ Investments

-

24+

Years in Business

The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please call toll-free 713-403-8250. The Adjusted Expense Ratio is 1.00%. The Adviser has contractually agreed to waive fees or reimburse expenses to limit total annual fund operating expenses (excluding management fees, Rule 12b-1 distribution and service fees, acquired fund fees and expenses, interest expenses, and certain extraordinary expenses) to no more than 1.00% of the Fund’s average monthly net assets (the “Expense Cap”). The gross expense ratios for class I is 3.02%. The Adviser may recoup waived fees, reimbursed expenses or directly paid expenses if (i) the waived fees, reimbursed expenses or directly paid expenses have fallen to a level below the Expense Cap and (ii) the reimbursement amount does not raise the level of waived fees, reimbursed expenses or directly paid expenses in the month the reimbursement is being made to a level that exceeds the Expense Cap applicable at that time. These contractual arrangements will remain in effect for at least two years from the effective date of the Fund’s registration statement on Form N-2 unless the Fund’s Board of Trustees approves their earlier termination.

Latest Fund Update

Why Private Markets?

Since 1986, Private Equity has been one of the best performing asset classes in the U.S.

Since 1986, Private Equity* (the buying, growing and selling of privately owned businesses) has been one of the best performing asset classes in the U.S., producing over 50% higher annualized returns than the S&P 500. 1

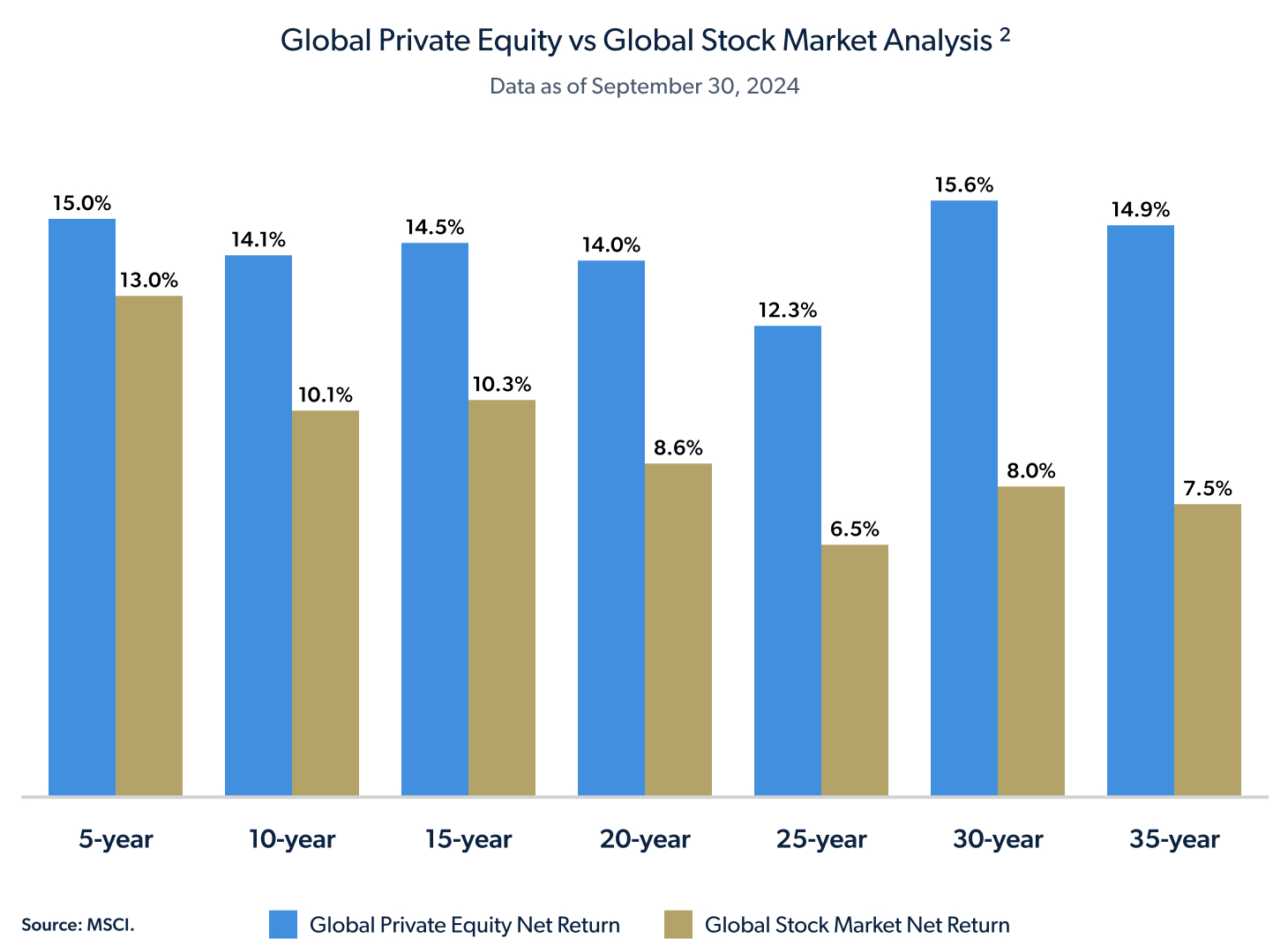

On a global level, Private Equity has substantially outperformed global stock markets over various time periods over the last 25 years.

Private Equity and Public Equity differ in several aspects. Private Equity investments typically involve higher costs and expenses, including management fees and carry fees, due to the active involvement in the companies and the longer investment horizon. In contrast, Public Equity is generally more liquid, allowing investors to buy and sell shares on exchanges easily, whereas private equity investments are illiquid. Furthermore, Private Equity can feature more significant fluctuations in principal and return, as the performance is driven by the success of individual investments, while Public Equity returns are more directly influenced by market conditions and can be volatile in the short term.

Long periods of outsized returns have caused a surge in popularity for Private Equity however there are other significant factors that are helping grow their popularity.

America has lost nearly half of its publicly traded companies. In 1990, US Exchanges had over 8000 companies. Today, that number is below 3800. 3 The universe of public companies in which to invest is getting smaller. In fact, the global value of all companies held by private equity funds dwarfs public stocks by nearly 4 to 1. 4

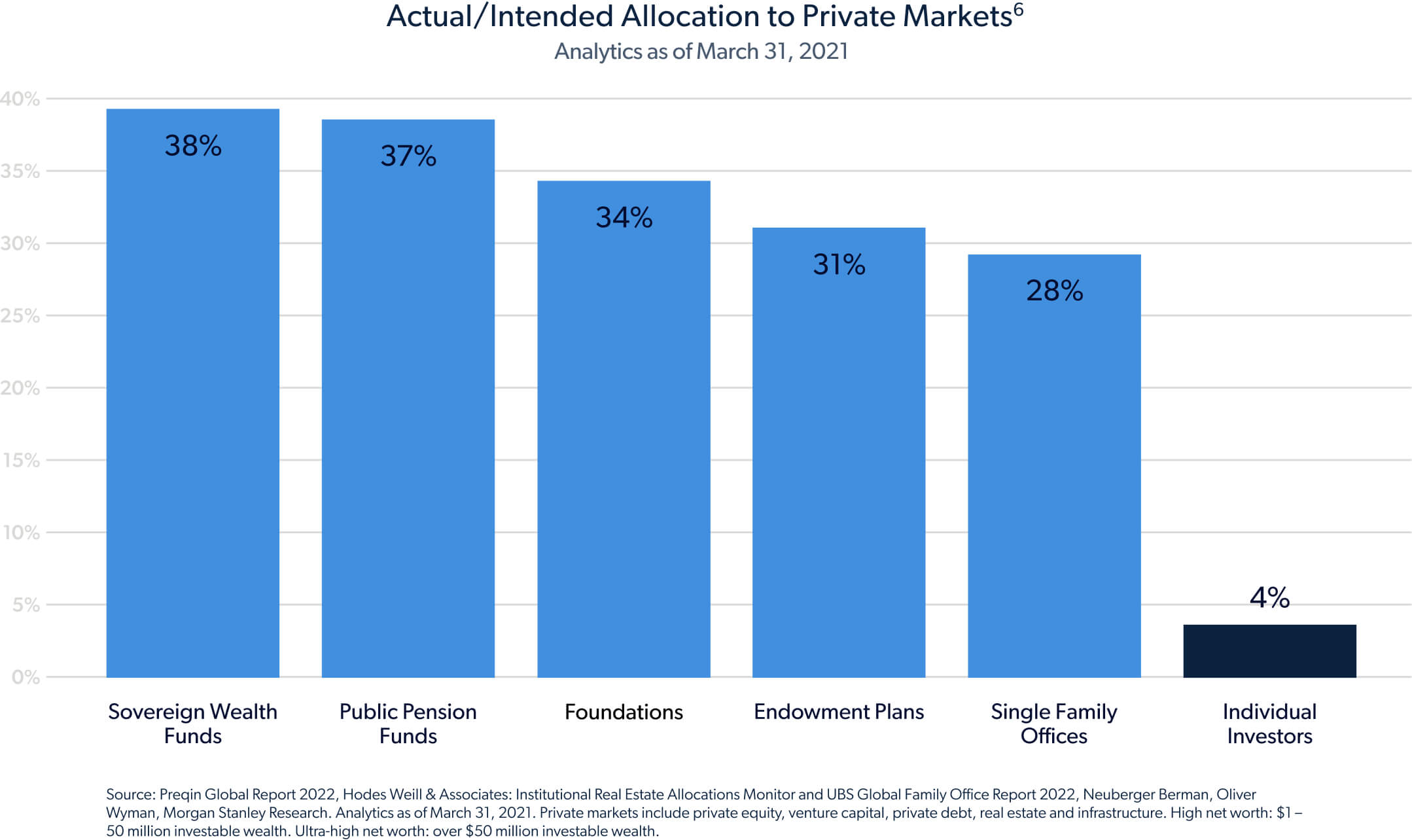

And while there are still many great publicly traded companies, 87% of U.S. companies with over $100 million in revenue remain privately held. 5 This is why the world's biggest institutional investors, from endowments to sovereign wealth funds, have allocated trillions of dollars into private markets.

Unfortunately, most individual investors have been excluded from these opportunities. Large minimums, long lock-up periods and limited liquidity, has made accessibility limited so individual investors have just 1% of their portfolio (on average) allocated to private markets opportunities.

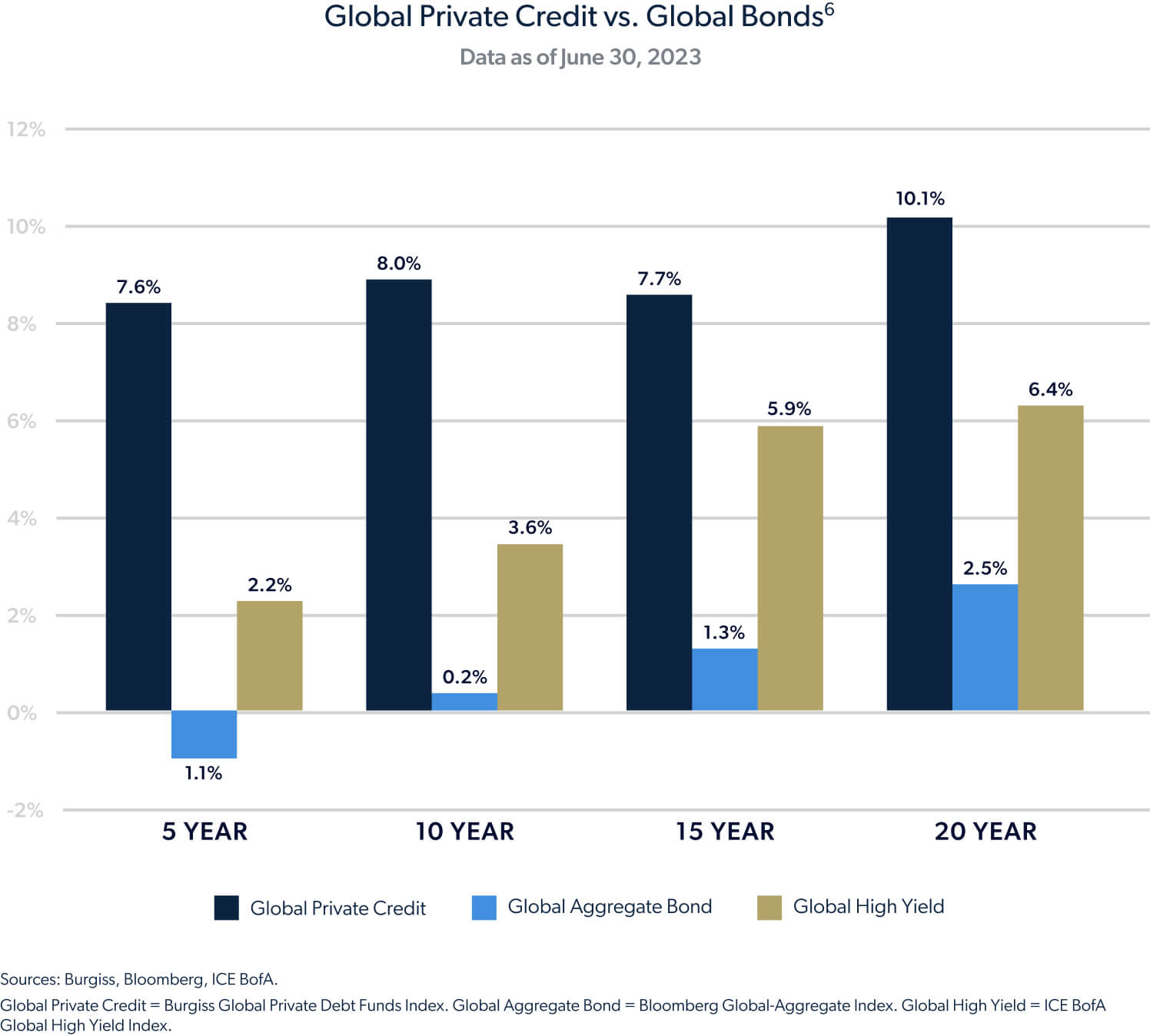

Investing in fixed-income securities involves varying degrees of risk. Global Aggregate investments, primarily in investment-grade bonds, generally offer lower potential returns with lower volatility and higher liquidity. Global High Yield bonds and Leveraged Loans, which invest in lower-rated or indebted companies, offer the potential for higher returns but can come with higher credit risk and price volatility, along with lower liquidity. Global Private Debt, involving direct lending to non-public companies, may offer potentially higher yields but can carry illiquidity and can involve more complex risk assessments. The asset classes in this chart are indices and do not represent a single investment. As such, investors should consider the varying levels of risk and expense profiles. Investors should consult a tax professional to learn more about the potential tax differences between potential investments.

Invest NowFUND FACTS

The Strategic Opportunities Fund by the Numbers

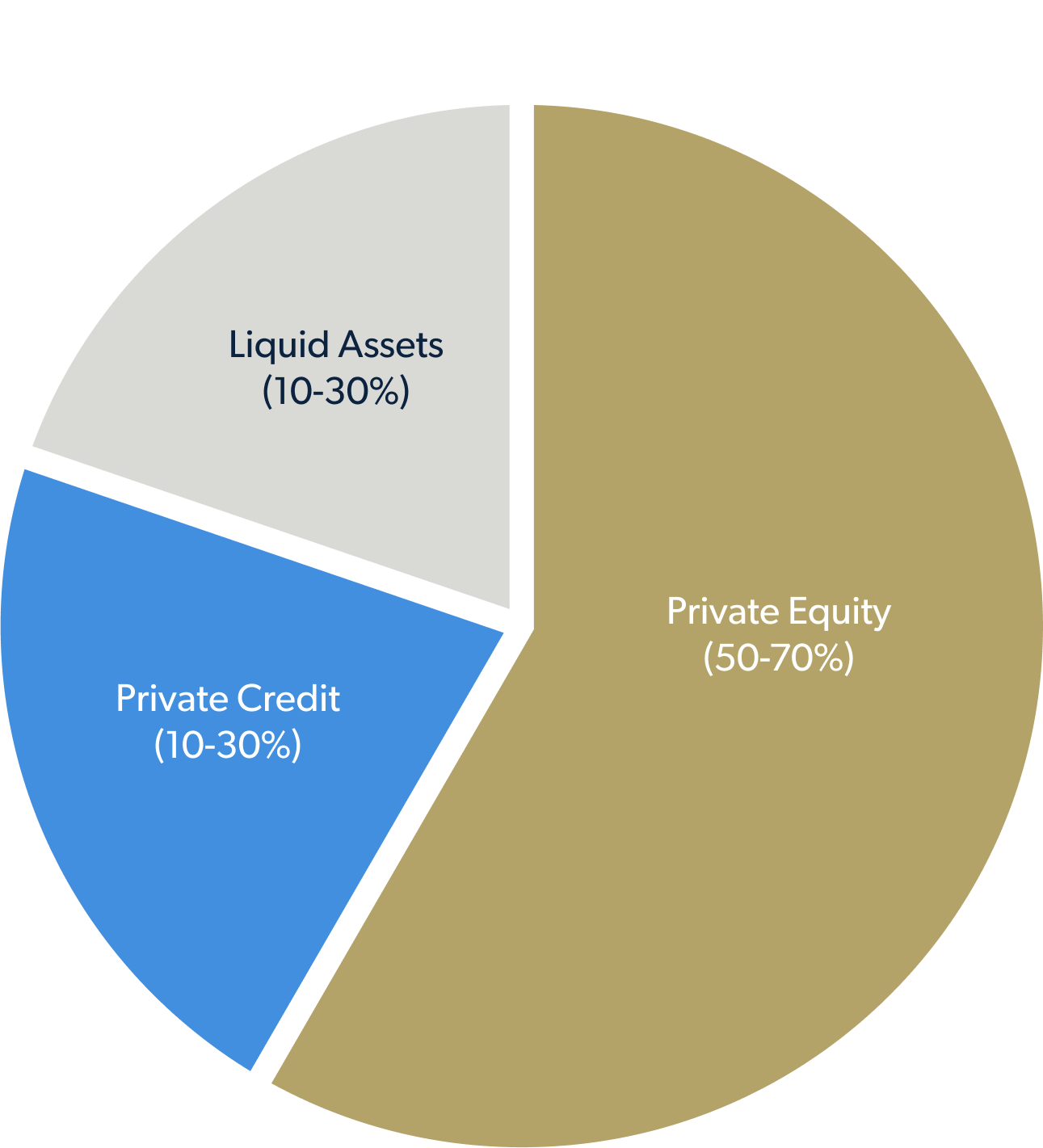

The CAZ Strategic Opportunities Fund seeks to eliminate the many traditional barriers to entry by giving investors access to a broad portfolio of private investments with a low minimum and increased liquidity.

The fund seeks to comprise a minimum of 8-15 low or non correlated types of assets. This simply means that the investments are unlikely to move up or down in unison. Research done by Ray Dalio and Nobel Laureate Harry Markowitz, has shown that a portfolio with numerous uncorrelated investments can help reduce risk by as much as 80% while providing the opportunity for even greater upside potential.

The CAZ Strategic Opportunities Fund is structured as a registered vehicle that aims to provide long term returns using growth oriented private equity investments and yield generating private credit investments across various market segments, geographies, industries. The balance of the fund includes a diverse set of liquid assets and credit solutions to target greater liquidity for the fund while also providing growth potential and additional portfolio income.

Liquidity for the fund's shares will be provided only through quarterly repurchase offers in an amount up to 5% of the fund's net asset value, and there is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. Additionally, repurchases will not begin until the fifth full calendar quarter after the fund has commenced operations. Furthermore, due to these restrictions, an investor should consider an investment in the fund to be of limited liquidity.

-

$2,500

Minimum Investment - No Maximums

-

Quarterly8

Liquidity

-

1099 Yearly

Simplified Tax Reporting

-

Qualified

& non-qualified accounts (IRA, Roth,

Rollover) -

Daily

Investments Accepted

FAQ

Investors should consider the investment objectives, risks, and charges and expenses of the Fund(s) before investing. The prospectus {and, if available, the summary prospectus,} contains this and other information about the Fund(s) and should be read carefully before investing. The prospectus may be obtained at (855) 886-2307 or www.cazstrategicopportunitiesfund.com.

The Fund should be considered a speculative investment and entails substantial risks,and a prospective investor should invest in the Fund only if it can sustain a complete loss of its investment.

Risk Considerations

Investing involves risk, including loss of principal. The value of the fund's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results.

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

There is a risk that issuers and counterparties will not make payments on securities and other investments held by the Fund, resulting in losses to the Fund.

Equity securities are subject to market, economic and business risks that may cause their prices to fluctuate.

Fixed income investments are affected by a number of risks, including fluctuation in interest rates, credit risk, and prepayment risk. In general, as prevailing interest rates rise, fixed income prices will fall. The Fund is newly formed and has no operating history.

The CAZ Strategic Opportunities Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

CAZ Investments does not provide tax advice. Please consult your tax advisor before making any decisions or taking any action based on this information.

Diversification does not ensure a profit or guarantee against loss.

CAZ Investment Registered Adviser, LLC is not affiliated with “Ultimus Fund Distributors, LLC.”

Sources & References

- Source: Preqin.

- Source: MSCI. Global Private Equity Net Return = MSCI Global Private Equity Closed-End Fund Index (Unfrozen; USD). A calculation based on data compiled from 8,011 funds with a start date of 4/1/1978. Global Stock Market Net Return = MSCI World TR Net USD. The MSCI World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries*. With 1,352 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. Private equity index returns are presented as annualized returns calculated using a time-weighted methodology, comparable to public market indexes. These returns are shown net of fees, expenses, and carried interest. Public market index returns (such as MSCI World TR Net USD and S&P 500 Composite TR) are presented as annualized time-weighted returns. They do not account for issues specific to private capital investing, such as capital calls, distributions, and liquidity constraints. Private equity and public equity differ in several aspects. Private equity investments typically involve higher costs and expenses, including management fees and carry fees, due to the active involvement in the companies and the longer investment horizon. In contrast, public equity is generally more liquid, allowing investors to buy and sell shares on exchanges easily, whereas private equity investments are illiquid. Public equities are subject to market fluctuations and regulatory oversight, while private equity can offer more stability through active management. Furthermore, private equity can feature more significant fluctuations in principal and return, as the performance is driven by the success of individual investments, while public equity returns are more directly influenced by market conditions and can be volatile in the short term. PAST PERFORMANCE IS NOT A GUARANTEE OF CURRENT OR FUTURE RESULTS. Historical examples shown do not, nor are they intended to, constitute a promise of similar future results. The information and statistical data contained herein are taken from sources believed to be accurate and have not been independently verified by CAZ Investments. Historical examples are provided for information purposes only and are not intended to represent any particular investment.

- Source: www.cnn.com. Article published June 9, 2023.

- Source: Preqin, World Federation of Exchanges

- Source: Capital IQ (January 2022)

- Sources: Global Private Debt = Burgiss Global Private Debt Funds Index. A financial index that tracks the performance of private debt funds globally, encompassing various debt categories. Global Aggregate = Bloomberg Global-Aggregate Index. A measure of global investment grade debt from twenty-seven local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. Global High Yield = ICE BofA Global High Yield Index. This tracks the performance of U.S. dollar, Canadian dollar, British pound, and euro denominated below investment grade corporate debt publicly issued in the major domestic or eurobond markets. Leveraged Loan Index = Credit Suisse Leveraged Loan Index. This index tracks the investable market of the U.S. dollar denominated leveraged loan market.

Traditional fixed income refers to publicly traded assets and securities that pay a set level of income to investors, typically in the form of fixed interest or dividends Investing in fixed-income securities involves varying degrees of risk. Global Aggregate investments, primarily in investment-grade bonds, generally offer lower potential returns with lower volatility and higher liquidity. Global High Yield bonds and Leveraged Loans, which invest in lower-rated or indebted companies, offer the potential for higher returns but can come with higher credit risk and price volatility, along with lower liquidity. Global Private Debt, involving direct lending to non-public companies, may offer potentially higher yields but can carry illiquidity and can involve more complex risk assessments. The asset classes in this chart are indices and do not represent a single investment. As such, investors should consider the varying levels of risk and expense profiles. Investors should consult a tax professional to learn more about the potential tax differences between potential investments. - Source: Preqin Global Report 2022, Hodes Weill & Associates: Institutional Real Estate Allocations Monitor and UBS Global Family Office Report 2022, Neuberger Berman, Oliver Wyman, Morgan Stanley Research. Analytics as of March 31, 2021. Private markets include private equity, venture capital, private debt, real estate and infrastructure. High net worth: $1 – 50 million investable wealth. Ultra-high net worth: over $50 million investable wealth. Analytics as of March 31, 2021.

- The Adviser intends to recommend quarterly repurchases of up to 5% of the Fund’s outstanding shares, subject to Board of Trustees approval; 2% early repurchase fee imposed for repurchases within one year of investment. Investors may not be able to fully liquidate investments for a long period of time and should not invest money needed in the near- to medium-term.

Definitions

The Burgiss Global Private Debt Funds Index is comprised of global funds in all private debt categories including generalist, senior, mezzanine, distressed, unclassified and unknown.

The Bloomberg Global- Aggregate Index is a flagship measure of global investment grade debt from a multitude of local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging market issuers.

The ICE BofA Global High Yield Index tracks the performance of USD, CAD, GBP and EUR denominated below investment grade corporate debt publicly issued in the major domestic or Eurobond markets.